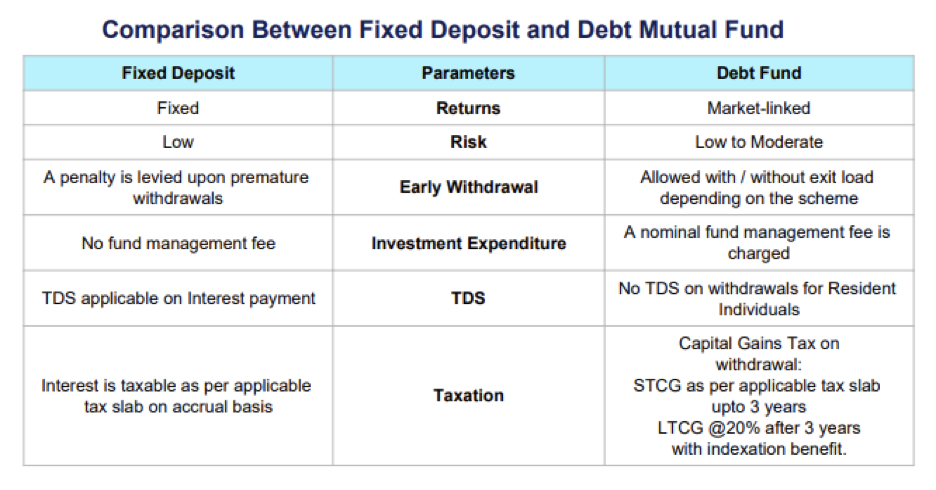

Currently, there are two most popular methods of investing – Fixed Deposits & Debt Mutual Funds. These two methods of investment are normally do meet primary goals of an investor which are low risk investment avenue, seek returns in 5 years & to gain atleast 8% to 9% of rate of returns. But then there are certain aspects like benefits, features that differentiate them & the difference in the way they work can be of advantage or disadvantage depending on the type of investor one is.

Fixed Deposits

Fixed Deposits are most popular investments for most investors. The key features that make them popular is safety, Liquidity (you can withdraw the amount by paying a small penalty anytime before maturity) and the returns are known in advance as Fixed Deposits indicate the rate of interest that any investor will earn. The interest income that you earn from Fixed Deposits gets added to your total income and hence the tax rate that is applicable depends on your total income. If you are in the highest tax bracket then you will be paying a tax rate of 30% plus applicable surcharges. Most investors are also subject to Tax Deduction at Source (TDS) on the interest payments.

Mutual Funds

Debt Funds / Liquid Funds are categories of mutual funds that invest 100% of the underlying investments in debt securities. In other words, these funds do not take any exposure to the equity markets. Hence these funds are relatively less volatile than the equity funds.

Debt Funds / Liquid Funds carry risks that are inherent to debt securities viz. Credit Risk, Interest Rate Risk and Liquidity Risks.

Unlike a Fixed Deposit, open-ended debt mutual funds do not carry any maturity date and hence the investors have the flexibility to withdraw anytime that they need the money.

Investors can also opt for the Systematic Withdrawal Plan (SWP) if they wish to need to withdraw money for their regular needs.

Once the investor redeems (withdraws) from the debt/liquid funds scheme, the gains that accrue are taxed as Short Term Capital Gains (holding period of below 3 years) / Long Term Capital Gains (holding period greater than 3 years). This can be advantageous for investors in the highest tax bracket.