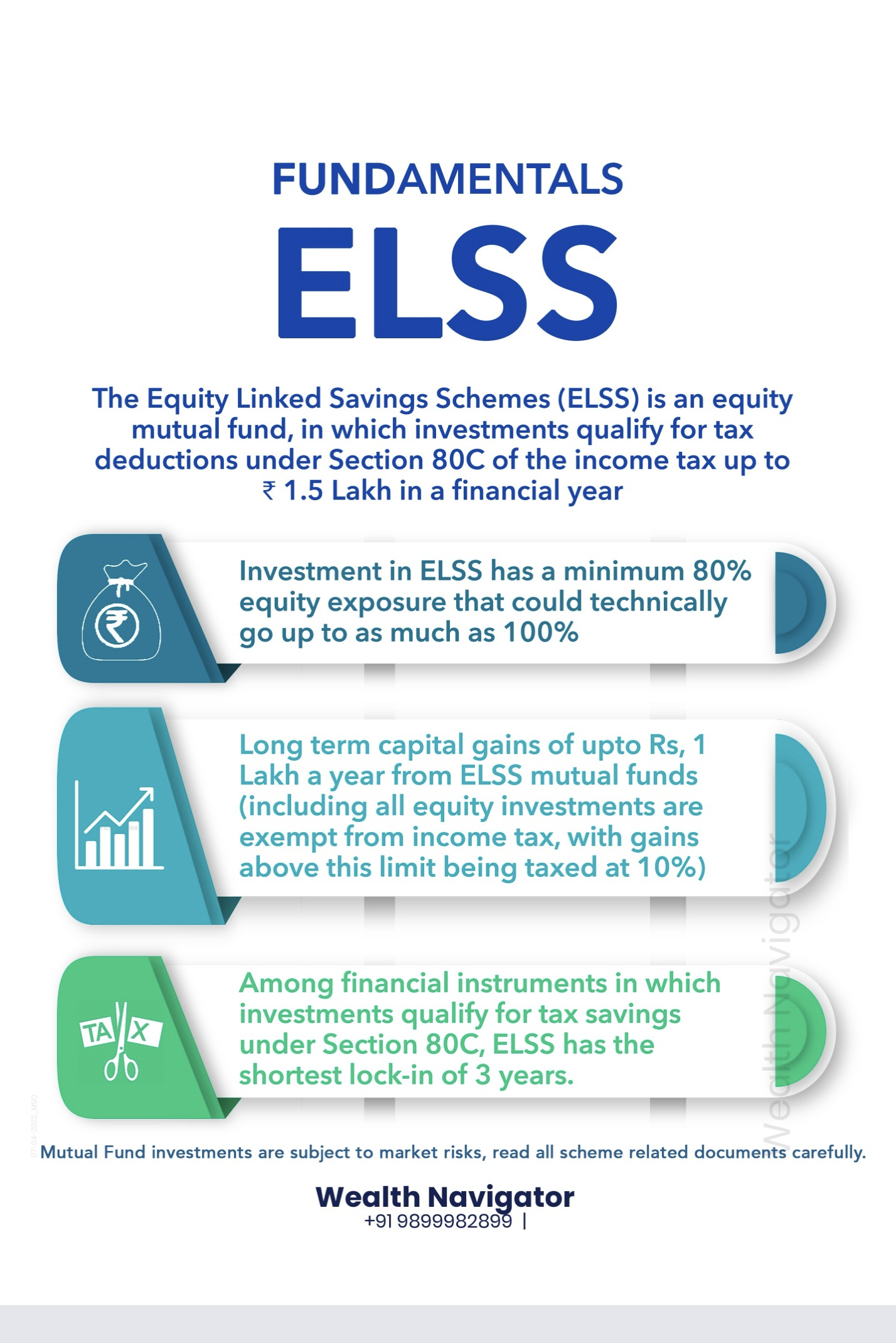

ELSS OR Equity Linked Savings Scheme, as the name suggests, is an equity based mutual fund. Through ELSS, one can invest in tax saving mutual funds. There are many advantages to investing via ELSS like:

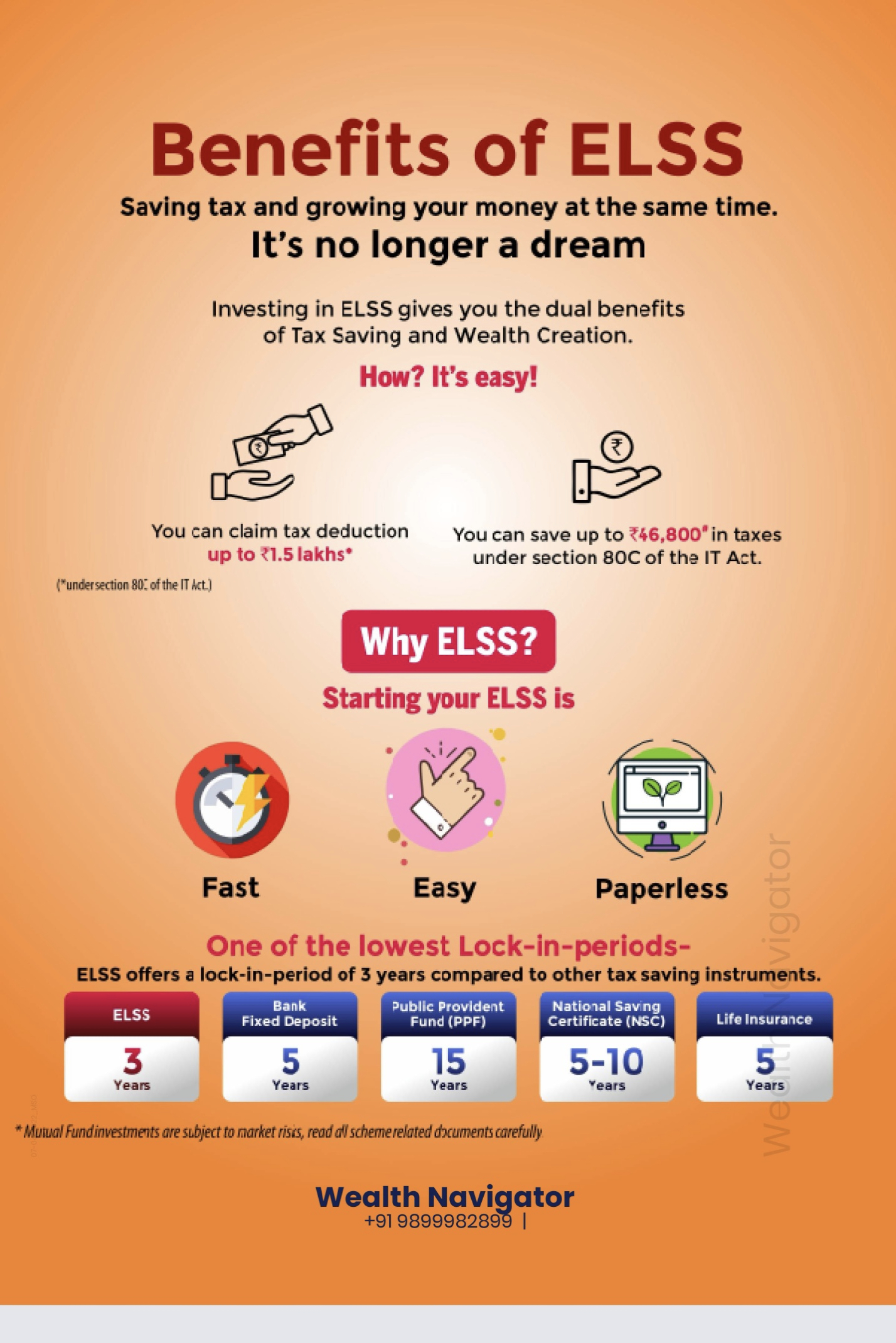

- Avail tax deductions under Section 80C

- Your principal amount gets multiplied due to the POWER OF COMPOUNDING

- The returns you earn within the lock in period are TAX FREE

- Substantially HIGHER RETURN

- Minimum lock in period of 3 YEARS

ELSS is an equity diversified fund & investors enjoy both the benefits of capital appreciation as well as tax benefits. But for long term, ELSS generate better returns though with slightly higher risk.

Benefits of ELSS

Here’s some points of advantage one can derive by investing in ELSS:

Equity’s Potential in Getting Return

Equities are known for giving potentially higher long-term gains compared to other tax saving instruments available in the market. So, with ELSS, one can more effectively & efficiently construct a portfolio keeping in mind the long-term perspective.

Tax Saving Instruments

Under section 80C, investments in ELSS are exempt from tax. And the returns received from equity funds after the end of 1 year is also tax free. As ELSS funds come with a lock in period of 3 years, the returns, dividends, capital gains also become tax free.

Outperforming Funds

If you want to save money & earn higher return of approximately 15 percent & more than ELSS funds are the way to go.

Financial Goal Planning

With inflation beating returns, ELSS funds are the best when it comes to long term financial planning. Under the guidance of an expert financial advisor, one can easily achieve the set goals of buying their dream home, children’s education, wedding, car & much more.

Less Lock in Duration

ELSS funds have a 3-year lock in period, which is less as compared to other investment avenues like PPF, FDs, NSC.

Investment Option

One has an option of either investing in one go i.e. lumpsum amount or can opt for SIP. SIP or Systematic Investment Planning is where a certain amount gets deducted from your account on a monthly basis.